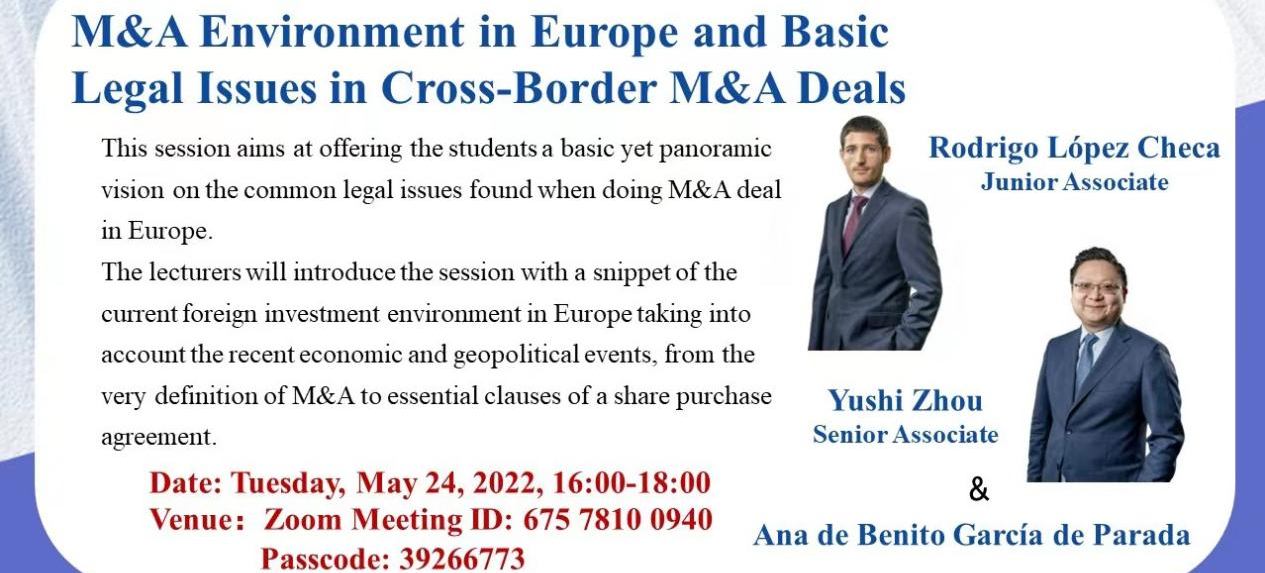

On 24 May 2022, the third lecture of the 2022 CESL Frontiers of International Legal Practice was held online via Zoom meeting. Rodrigo López Checa, an associate at URÍA MENÉNDEZ, and Yushi Zhou, a senior associate at URÍA MENÉNDEZ, were invited to give a lecture on the “M&A Environment in Europe and Basic Legal Issues in Cross-Border M&A Deals” to the students of the China-EU School of Law (CESL).

The “International Legal Practice Lecture Series” was organized to highlight the objective of the CESL to cultivate legal talents with an international perspective. It also promotes the diversification of the curriculum and teaching modes by bringing practitioners into the classroom.

At the beginning of the lecture, Yushi Zhou gave a brief introduction of the current investment environment in Europe. Although there are some restrictions, it is generally friendly: capital can move freely except in exceptional circumstances. The EU remains open to foreign investment, despite the screening mechanism for foreign direct investment due to Covid-19. Yushi Zhou then summarized the basic concepts of M&A and described how they are carried out: share purchase or asset purchase agreements; public take over; corporate restructuring, merger, consolidation, transformation, and spin-off.

Rodrigo López Checa then described the standard M&A process: Step 1: understanding the tax structuring; Step 2: signing preliminary documents (NDA, MOU, etc.); Step 3: due diligence; Step 4: negotiating and signing contracts; Step 5: making antitrust filings; Step 6: closing. Yushi Zhou added that if one is to be an excellent M&A lawyer, one must understand various facets including the tax structuring very well.

Finally, Yushi Zhou explained the most common difficulties and challenges for Chinese investors investing in Europe. Common difficulties for Chinese investors investing abroad include restrictions on foreign exchange, lengthy PRC regulatory process, translation issues, etc. Common concerns of Chinese investors include lack of understanding of target jurisdiction, national security reviews or other forms of government intervention, bias issues, and integration issues (especially in a cross-cultural context).

The seminar provided students with a deeper and more comprehensive understanding of M&A. The seminar also inspired students to think about the legal issues in cross-border M&A transactions. The success of this lecture provided an opportunity to understand the European M&A environment and built a platform for students to broaden their international perspectives.

Written by: CHEN Xing, CESL double master from 2021 intake

The First Lecture on Frontiers of International Legal Practice - IP Due Diligence

The Second Lecture on Frontiers of International Legal Practice - Compliance for Doing Business in China