On June 23, 2020, the second lecture of the China-EU School of Law’s foreign-related guest lecture series was held. This lecture focused on corporate mergers and acquisitions. The lecture was headed by Mr. Antonio Sánchez Cerbán, a partner of the leading Iberian and international law firm of Uría Menéndez. Speaking from Madrid, he was joined by two of his colleagues in giving the presentation, associate Ms. Xu Shanshan and Mr. Carlos Rivera Leyva. CESL European Executive Co-Dean Monty Silley presided over the lecture.

The main content of this lecture was divided into five parts. The first part was an overview of the foreign investment environment in Europe; the second part introduced the basic concepts of corporate mergers and acquisitions; the third part introduced six key themes, including control of auctions, tax structure, merger control, labour law, listed companies and mergers and acquisitions, which was also the general theme in the fourth part; the fifth part described the challenges faced by Chinese investors; and the last past described how to bridge cultural differences between China and Europe.

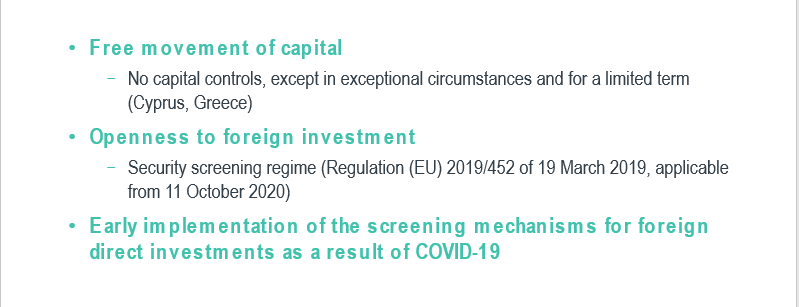

At the beginning of the lecture, Ms. Xu Shanshan pointed out that the foreign investment environment in Europe is basically friendly, but there are some restrictions. She mentioned the free flow of capital, opening up to foreign investment, and the early implementation of a foreign direct investment (FDI) review mechanism. This is also related to the Covid-19 situation, in order to avoid the loss of some key facilities and technologies, such as medical or protective equipment manufacturing, health care facilities and related institutions. Next, she introduced the basic concepts of corporate mergers and acquisitions, as well as different methods of mergers and acquisitions and some common steps.

Subsequently, Mr. Carlos Rivera Leyva introduced five key themes of public bidding, tax structure, merger control, labour law, and listed companies. First, he explained the public bidding process from the perspective of strategic considerations and the seller's desire to quickly conclude the transaction. Secondly, related to tax structure, he analysed why and where to set up a holding company. Again, he explained the merger control system and the main thresholds for merger control. Next, he summarized the relevant knowledge of forced transfer of employment relationships and employment protection mechanisms in the case of asset transactions. Finally, he introduced the relevant content of listed companies on corporate mergers and acquisitions from three aspects: continuous disclosure obligations, mandatory acquisition offers and passive rules. After finishing the explanation of these key themes, Ms. Xu Shanshan introduced the next topics in corporate mergers and acquisitions, including transaction structure, statements and guarantees, compensation clauses, escrow accounts, and so on.

Immediately afterwards, Ms. Xu Shanshan also introduced the challenges faced by Chinese investors, including the common difficulties for Chinese investors to invest overseas and the issues that Chinese investors are paying special attention to.

Finally, Ms. Xu Shanshan vividly introduced the differences between Chinese and Western cultures in the form of pictures, and analysed how to best bridge such cultural differences from a practical perspective. After the main content was explained, the lecture entered an interactive Q&A session. The students actively asked questions about the impact of Brexit and foreign direct investment laws on European mergers and acquisitions. Attorney Antonio Sánchez Cerbán answered the questions in detail for everyone, and the lecture ended with a very pleasant atmosphere.

Written originally in Chinese by: Yuan Ruiting (double master student at CESL)